Banks Negative position

Three months ago the Bank of Canada (the equivalent of the Fed in the US) lost money for the first time in 80.

Posthaste: Bank of Canada could lose up to $8.8 billion over next few years: report

'Preferred estimate' is for a loss of $5.7 billion, C.D Howe says

“Tiff Macklem, the central bank governor, surprised the country’s financial and political communities when he told the House finance committee in November that the bank would lose money for the first time since its founding in 1935.”

I saw this video 3 months ago. I thought it pertinent to review. I had quite a difficult time finding it. YOU CAN’T FIND IT ON YOUTUBE IF YOU SEARCH ON YOUTUBE FOR IT. You get Scheer’s resignation, any dirt on him etc. You get hours of FINA for Jamaica. I had to go through Yahoo and scroll for a good half hour.

Don’t you like the new search functionality that is ‘curated’ for narrative. (Wasn’t google’s main advantage back IN THE day was fast search results, not chosen to bend your brain results- MY BRAIN HURTS. This is why a ‘faster’ phone means nothing. You get to the curated ‘findings’ for you. Is it even ‘finding’ if it is meant for you to see? They aren’t even breadcrumbs to the oven anymore. They are a road of narrative cupcakes. So no 5G has no advantage. Patience is the new paradigm.

MP Andrew Scheer starting at minute 1:53 took the Standing Committee through a series of critical questions. Play it on a loop for it to sink in. Especially if you are a novice to financial concepts outside balancing your own budge responsibly. That is something incumbent upon you to do, but apparently not those…. running central banks.

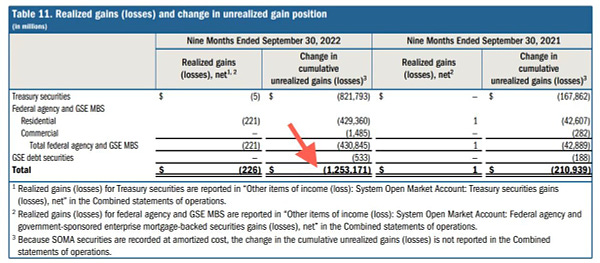

Bank is losing money; because it has to pay interest on the settlement accounts. Now that the interest rates have gone up. The interest payments are greater than what the bank receives from the government on the bond rate itself

“What we are paying on our settlement balances, our liabilities is larger than the interest were receiving on our assets which are largely Canada Bonds.”

Who is receiving the interest payments? big 5 banks

Who covers the delta on that? to cover those losses?

THIS QUESTION IS WHO BAILS OUT THE BANK OF CANADA?

Andrew Scheer unfortunately is no longer on the committee. Unfortunate is a choice word that may be subjective depending on whether narrative is important. On March 9, 2023, this committee met to discuss:

Last meeting: Thursday, March 9, 2023

Information

Meetings

Expand All Collapse All

If you hit the tab that says “Minutes” this is what you get:

”Department of Finance

• Robert Sample, Director General, Financial Stability and Capital Markets Division, Financial Sector Policy Branch

• Matthew Boldt, Director, Markets and Securities Policy, Financial Sector Policy Branch

Pursuant to Standing Order 108(2) and the motion adopted by the committee on Tuesday, March 7, 2023, the committee commenced its study of Current state of play on green finance, green investment, transition finance and transparency, standards and taxonomy.

Robert Sample made a statement and, with Matthew Boldt, answered questions.

Jasraj Singh Hallan gave notice of the following motion:

That given interest rates are at the highest levels since the 2008 recession and mortgages have significantly increased since 2015, the Standing Committee on Finance undertake a study on the impact of inflation and interest rates on mortgages in Canada, and that the study includes, but is not limited to, the increase in the number of mortgages hitting their trigger rate and the number of mortgages that have had their amortization period increased beyond 25 years, that the committee include in its witness list the Canadian Mortgage and Housing Corporation, the Office of the Superintendent of Financial Institutions, and representatives from the “Big 6” Canadian banks, that the committee take no less than four meetings for this study, and that the Committee report its findings to the House.”

The committee proceeded to the consideration of matters related to committee business.

It was agreed, — That the proposed budget in the amount of $ 5,000, for the study of Bill C‑32, An Act to implement certain provisions of the fall economic statement tabled in Parliament on November 3, 2022 and certain provisions of the budget tabled in Parliament on April 7, 2022, be adopted.

It was agreed, — That the proposed budget in the amount of $ 2,200, for the study of Bill C‑241, An Act to amend the Income Tax Act (deduction of travel expenses for tradespersons), be adopted.

It was agreed, — That the proposed budget in the amount of $ 13,500, for the study of Current state of play on green finance, green investment, transition finance and transparency, standards and taxonomy, be adopted.

At 12:06 p.m., the committee adjourned to the call of the Chair. Alexandre Roger Clerk of the committee”

We are being ‘led’ by people who are instructing us on what our priorities need to be.

TOLD: Green and Rainbow and not the green of dollars.

Democracy is where the voters, tell the leaders where our priorities need to be. To that we get: Diversity, equity you ninnies! That’s what we need!

The irony I want to point out: is that not doing your job and flying flags has real world consequences that are born by the least advantaged of our society. My theory is that strong economic policy IS MORE COMPASSIONATE, than championing that you are working on diversity and failing the economy. Is that racist to think so? I doubt it. But it would hardly stop anyone with a mouthpiece to wrinkle and ewe in offense. Until they lose their life savings, home and ability to feed their family. Then hurry and give them a new profile picture in social media that says I didn’t stand with the economy because thinking that’s important might be INSERT FLAGRANT SOCIETAL disenfranchisement, queue epitome

There could fires …which don’t discriminate;

ambulances racing to save people from medical ailments that know no boundaries;

food insecurity and hunger that afflicts any religion;

child poverty;

young of any race or creed dying of myocarditis induced by the shots (YEP WAKE UP);

And the talking points would be dominated by equity rather than solving the problem!

You could be drowning and instead of life boat you get a lecture on critical race.

It’s a fantastic excuse to look like you’re solving the world’s problems on the one hand, PAT YOURSELF ON THE BACK, grab some esg credits, while with two other hands: you prevent those with solutions from acting, AND you cause the very problems that the people are suffering from.

The administration’s policies, entrench and increase poverty for all. A strong economy raises all boats, while energy poverty and wrong headed economic policies and inflation AFFECT THE POOR THE MOST. The democrats or Canadian Liberals or Euro fascists bath themselves in congratulatory moral high ground while they grind the poor and middle class into the ground. Hooray we aren’t averting the war! Hopefully many will die in the draft?

And who will they draft. Will it be you with the fabulous social credit score?

The technocratic left champion the cause, while waiving a flag in front of our faces; all the while kicking the poor in the NUTS.

This administration, like the Canadian elected liberals, remind me of travelling to Barcelona where pick pockets would accost you (like the Biden administration) to tell you the places you need to visit, (GREEN investments, managed by women and etc while getting out of cheap energy and energy security) waiving large brochures in front of your face (all Biden’s, airlines, banks, great news on Diversity).

These pickpockets used the fancy signs and maps to shield their hands or those of their group that picked your pocket. We are being robbed by virtue signalers. Oh well that’s ok then. They’re virtue signaling. Have all my money. F^&k OFF. WE AREN’T THAT DUMB. We are that craven to be thought well of.

The poor are disproportionately affected by inflation. And the middle class is wiping out their savings trying to stay afloat. So all that ‘flag waiving’ is a distraction from true harms. People are being used in terrible ways. The administration is focused on “ending racism” while hurting the most vulnerable groups.

Sound economic policies don’t read like ‘equity’ in terms of ‘moral high ground’, but Sound economic policies own the moral high ground.

Inflation through printing of debt is your government taking money straight out of your wallet. Homelessness is real, food insecurity and hungry children is real. Suffering has no race, or pronouns. So please stop the waiving we don’t believe you. When you find out Yellen back tracks on the making right the depositors over 250k, Does it help Oprah and Harry banked there? Maybe you also should only bank where these grubbers bank. It’s probably better insurance than the 250k.

”The fastest rate of inflation in 40 years is hurting families across the U.S. who are seeing ever-higher prices for everything from meat and potatoes to housing and gasoline.

But behind the headline number that’s been widely reported is something that often gets overlooked: Inflation affects different households in different ways – and sometimes hurts those with the least, the most.

Inflation, as calculated by the Bureau of Labor Statistics, is designed to track the price increases in a typical U.S. household’s basket of goods. The problem is spending bundles differ across households. For example, a family in the lowest 20% of income typically spends around 15% of their budget on groceries – this is nearly 60% more than households in the top 20% of the income distribution, according to my calculations.”

Did the massive printing of more MONEY for Biden pet causes help reduce inflation? NO. It’s a Climate Change legislation: think C40, 15 minute cities, open air prisons.

Was the monetary policy weaponized against ordinary people?

inflation: robs the poor;

interest rates: slows the economy;

the speed of the interest rate changes: destabilizes the banks;

and bursts the housing bubble

and has people hitting their trigger rates.

Are they running the government and central banks to help the people or do we get to a socialism that is heretical and closer to feudalism. Those in charge VIRTUE SIGNAL. Its a flashy distraction that can even be polarizing.

Aww Jeez, that’s so thoughtful of you to use tax payer money to impoverish them with inflation and buying essential goods; increasing debt servicing; expose citizens to the creditors of that debt AND of course use the money against citizen interest.

“The Inflation Reduction Act (IRA) passed the U.S. Senate on August 7, 2022 and was signed into law by President Joseph R. Biden on August 16. The law has been lauded as the biggest climate change legislation in the history of the United States, with Democrats and supporters touting the law’s historic climate and clean energy investments.

In total, the IRA includes $228 billion in appropriations and an additional $324 billion in tax expenditures. The majority of the bill’s spending is climate- and energy-oriented, but also makes consequential changes to corporate tax law and Medicare.”

INFLATION…. CLINFLATION… CLIMATION…. CLIMATE. YA.

Did you think something with the name “Inflation Reduction” would have as its objective, to reduce inflation? Inflation and the price of eggs was garnering a lot of media, so any Republican who didn’t vote for ‘REDUCING INFLATION’ would be held up to the mafia. I mean, the news pundits. It was a set-up. Name it the thing the population need resolved regardless of what it actually purports to do. Worse name it the opposite of what it is supposed to do.

The Republicans want to look at Biden’s policies to see which are actually hurting Americans. Want a list?

Another country is set to default on its debt. The outcome will be one to watch: how will that be used to further pivot the citizens of Pakistan to technocracy? Think vaccine passports and digital Id.

Silicon Valley Bank Included in 2022 Bloomberg Gender-Equality Index

“SVB continues work to advance gender equality and build a diverse and inclusive workplace

January 26, 2022

SANTA CLARA, Calif. – January 26, 2022 – Silicon Valley Bank, the bank of the world’s most innovative companies and their investors, today announced that it has been included in the Bloomberg Gender-Equality Index (GEI) for the fourth year running. The Bloomberg GEI is a modified market capitalization-weighted index that aims to track the performance of public companies committed to transparency in gender-data reporting. This reference index measures gender equality across five pillars: female leadership & talent pipeline, equal pay & gender pay parity, inclusive culture, anti-sexual harassment policies, and pro-women brand.

“Silicon Valley Bank is deeply committed to advancing gender parity and fostering diversity and inclusion, in our workplace and in the innovation economy at large,” said Greg Becker, CEO of Silicon Valley Bank. “Our clients, company and communities are made stronger when people of diverse backgrounds and experiences are able to bring their ideas and expertise to bear.”

“We are proud to recognize Silicon Valley Bank and the other 413 companies included in the 2022 GEI for their commitment to transparency and setting a new standard in gender-related data reporting,” said Peter T. Grauer, Chairman of Bloomberg and Founding Chairman of the U.S. 30% Club. “Even though the threshold for inclusion in the GEI has risen, the member list continues to grow. This is a testament that more companies are working to improve upon their gender-related metrics, fostering more opportunity for diverse talent to succeed in their organizations.”

Silicon Valley Bank submitted a survey created by Bloomberg in collaboration with subject matter experts globally. Those included on this year’s index scored at or above a global threshold established by Bloomberg to reflect disclosure and the achievement or adoption of best-in-class statistics and policies.

“SVB is on a journey to increase representation and inclusivity for women in our workplace,” said Angela Morris Lovelace, Chief Diversity, Equity and Inclusion Officer at Silicon Valley Bank. “We are proud to have our efforts recognized in this way, and we will continue to report on our work to hold ourselves accountable to the crucial imperatives of gender and racial equity.”

The 2022 GEI expands globally to represent 45 countries and regions, including firms headquartered in Colombia and Uruguay for the first time. Member companies represent a variety of sectors, including financials, technology and utilities, which collectively have the highest company representation in the index.

Both the survey and the GEI are voluntary and have no associated costs. Bloomberg collected this data for reference purposes only. The index is not ranked. While all public companies are encouraged to disclose supplemental gender data for their company’s investment profile on the Bloomberg Terminal®, those that have a market capitalization of USD 1 billion are eligible for inclusion in the Index. For more information on the GEI and how to submit information for next year’s index visit: https://www.bloomberg.com/gei. Bloomberg clients can access the GEI at {BGEI Index DES <GO>}.

For more information on Bloomberg’s sustainable finance solutions, including the GEI, please visit: https://www.bloomberg.com/professional/sustainable-finance/.

Media Contacts:

Lucy Muscarella

Silicon Valley Bank

lmuscarella@svb.com

Bloomberg Media Contact: GEIComms@bloomberg.net

About Silicon Valley Bank

Silicon Valley Bank (SVB) helps innovative companies and their investors move bold ideas forward, fast. SVB provides targeted financial services and expertise through its offices in innovation centers around the world. With commercial, international and private banking services, SVB helps address the unique needs of innovators. Learn more at svb.com. [SIVB-C]”

I’m not saying lesbians ran the bank into the ground. That would be wrong on so many levels. I’m saying virtue signaling is distracting, for us but also for those who may have ‘jobs to do’.

Keeping the eye on the ball is important in any industry. They went from looking forward to a lot of parades and parties in the work place, to having no jobs.

I’m saying that all that waiving is of the maps at my waist level distract me while the thieves pick my pocket, is no way to run a bank or a country.

The question isn’t merely whether or not or how the financial system is managed: there has to be accountability for those pushing virtue signaling while harming such vast amounts of people. Can we be done with the side show and get down to real compassion: sound economic policies?