Bank Bail Ins Europe: NEW LEGISLATION MEANT TO END SMALL BANKS

Theme: Weaponization of Financial System

Bail-out. Read my lips. No More Bail-outs. But are we average Joes and Janes' paying attention? Do we understand the ramification of Bail-Ins. The Bail in laws legislation has just been altered and I think that altercation solidifies the path: TO FURTHER CENTRALIZING OF BANKS. AND therefore CBDC. I wonder if they play is to do the opposite and for a coordination of funds into small banks.

If you are a proponent of freedom and anti-globalist than this little piece of legislation announced this week is more tea leaves for THE PUSH TO A CENTRAL BANK DIGITAL AND PROGRAMMABLE CURRENCY. The war is on the smaller banks. If small banks want to stop their planned programmed elimination they need to go to court and block this recent legislation. Leaders in Europe that aren’t compromised to the march should be standing up and paying attention. It’s not just Brexit. You need Frexit. Germexit. and so on a so forth. Regionalization is the answer to Globalization.

OWN The money supply and what exactly? Quantum Currency. Measured in metered out. Allotted. It is no longer money. It is a mechanism of control. CBDC permits by the quantum consumption taxation and control. Carbon measured and allotment. (see my posts on carbon trackers). This is a controlled decimation on the Free Market Economy. How do you like your latte? with real cream. How do you like your burgers? with real cow?

The Vax-happies thought autonomy that did not end at their skin; the ones that shamed, and provided giddily for an economic apartheid for fellow citizens for insisting on an autonomy that did end at their skin; need to grow some awfully quickly. That being gonads, for non-compliance. That being synapses that fire to join the concepts that are not not twined. It is all one big hemangioma throbbing for those who see.

Some may believe that gender is the most important concept right now. And certainly to the individual battling whatever personal issues, it is important to them. There’s a ton of social issues; which one have Presidents, corporations, ESG, Health, Schools, governments, Pharma, NGOS, and oh so much MONEY.

The reason it is backed on such a scale (oh money what you tell me MONEY. what you are MONEY. - don’t you wish you could hear the song that goes with that). Money made it ubiquitous, Money made it powerful, the money trail tells us that it has a purpose other than ‘human rights’. It is the loudest crash of culture and it is loud because of what else is also happening. It may have a stand-alone ‘purpose’.

But all across society, everyone who gets herded by CBDC into the pen policed by an AI, cloud, of ‘betters’ will lose. What the spectrum of left v right has to understand, (and some of the right and the freedom fighters do understand), but much of the left and far left don’t is that PEN IS FOR US ALL. There is no flag that gets your real money back. Your future, your children’s futures and possibilities.

When has money been ‘existential’, when it can be weaponized to disappear, so it cannot purchase essentials. The cost of food was always going to be part of the equation. The diminishing power of dollar through inflation and burning heap of debt and a printing press of dollars on overdrive, was always part of the vision. Make the system untenable so that people walk in to their next ‘chains’ willingly.

Those motivated to do this, may throw a lot of money at the Rainbow flag now for what it is to our society and the purpose it has now. But when the shattering cage slams around, the funds will be parsed.

When Kamila Harris was mocked for saying a non-sequitur: The children of the community are the children of the community”, I knew it made sense. It made sense because our families STRONG, need to be untwined for their vision to be complete. The state should raise your kids? What will the kids ‘learn’ at $10/day day care in Canada. OH. I DON”T WONDER AT ALL.

Programmable Digital Currency utilized in China for Social credit score eliminates freedom. Your purchasing power, your ability to save for important purchases, an education, a home, a vacation that is eliminated. Social credit, quantum spying, eliminates this possibility. You may be in the beast, this is where the tide must turn. Maybe I’m saying to you, read the tea leaves with me. Maybe I’m saying, be self-interested enough to understand these plays and switch alliances. Maybe I’m saying all the companies lapping up their ESG, all the teachers in schools, all the bankers, all those in unions, all those in ‘bureaucracy’, those who ‘see’ their 'birth families’ as enemies, all those in the vanguard black rock etc etc are people with a self-interested view of the world that MAY not want the new QUANTUM SPYING. QUANTUM CURRENCY ALOTMENT, QUANTUM CO2 PARSING, etc. etc.

Your personal autonomy doesn’t just stop at your skin. It enters it. The speech you cannot say- say it louder. I wrote this below piece in January. It discusses the new ‘frontier’ in quantum-gigs, where you are ‘awarded’ for a ‘task’. Think you can save in this universe and ‘afford a home’. You won’t afford a latte. This is a Bill Gates patent and it has a 666 filing number. surely a ‘lucky’ coincidence he did not contrive at all.

(on another aside who are these lawyers BRILLIANT AF drafting our prisons- you get paid massive amounts, and I get 8$/monthly subscriber all 3- THANK YOU VERY MUCH by the way- to undo your work. Imagine I succeed? Well all battles are won in the mind first. People working for freedom are doing so for love of OUR world. Those working for our imprisonment are being lavished all kinds of treats and fantasies, even likely Epstein island fantasies. That means we will win. Read that again guys: we will win. To grease the wheel of oppression PAYMENTS must be made and oppressions must be provided. With every payment and oppression the equation is more burdensome and displays the truth- therefore, people will switch. On the other side, of the equation, those doing battle are doing it for LOVE and love only GROWS with effort. It only WELCOMES MORE. think of that. Because we do it for Love of Our World. That is sufficient payment. JOIN THE TRUE LOVE TRIBE, WHICH INCLUDES FREEDOM FOR ALL REGARDLESS OF SEX, RELIGION, BELIEF, RACE. Do you see why we will win even if you don’t see the how. In my view the How in the dismantling of all their tethered lines, their dots to dots. Everyone is in a place in front of themselves to untether. and to SPEAK. Where you are is where you exert your personal power, with the tools God gave you, your talents- think they are meager. Oh they are not they grow with utilization - like the parable of talents.)

Never look at things for what the Media Mafia has set out. See the endgame, and like dot to dot look at the ‘stimuli’ that you are being asked to examine and look at that final dot. And I say this even to the most dogmatically convinced that their current role in the dot to dot is vital to ‘human rights’ or ‘stopping school shootings’ or ‘climate change’. That final dot is under your skin control: think it isn’t? Think the ‘army of the final dot’ isn’t being deployed to keep armaments in the hands of the control matrix ONLY.

Should we get to the NEW TEA LEAVES I’VE BEEN READING? Let me know if you like my coffee-musings. Or if you prefer quick and straight to the facts. I’m not sure how that will effect my writing but it should as you are my readers.

“Taking as the most relevant example the US experience during the great financial crisis of 2008-13,[18] that period saw 489 small/medium bank failures managed by the FDIC for an overall amount of assets held in those banks of USD 683 billion.[19]

Only in 26 cases, with a total asset value of USD 16 billion, did the FDIC actually use the option to liquidate the bank’s assets and pay out the deposits. In all the other cases the FDIC implemented various types of purchase and assumption (P&A) transactions, i.e. acquisition of assets and assumption of liabilities by another credit institution.”

In the EU some regulations just got DROPPED in response to using tax payers money to ‘bail out’ small and regional banks.

LET’S THINK: so when we get into this are we going to see that the ‘orderly’ result of the bail ins is that small and regional banks that FAIL; ARE MEANT TO FAIL.

LET”S THINK; will we see that if they are MEANT TO FAIL, will the result be a an increase concentration of banking power to a few banks.

LET’s THINK: does that mean the power is supposed to get to the point where CBDC in Europe has no alternatives.

LET’s THINK: what are we going to find about depositer’s funds, when bail in’s are the preferred route.

There certainly is a lot of ‘regulations and laws’ setting this out. Sometimes I believe we have sound policy in the making when I read legislation. Sometimes instead I see legislation (and certainly more recently) as actual tea leaves on the future. Reading legislation is for anyone. What do you see with the newly dropped banking rules.

What is the SRB?

“The Single Resolution Board's mission

The Single Resolution Board (SRB) is the central resolution authority within the Banking Union, which at present is 20 eurozone countries and Bulgaria. Together with the national resolution authorities it forms the Single Resolution Mechanism. The SRB works closely with the European Commission, the European Central Bank, the European Banking Authority and national authorities. Its mission is to ensure an orderly resolution of failing banks, protecting the taxpayer from state bail-outs, which is promoting financial stability.”

What is the Single Resolution Fund?

“The Single Resolution Fund (SRF) is an emergency fund that can be called upon in times of crisis. It can be used to ensure the efficient application of resolution tools for resolving the failing banks, after other options, such as the bail-in tool, have been exhausted. The SRF ensures that the financial industry as a whole ensures the stabilisation of the financial system. All banks across the 21 Banking Union countries must pay a fee annually by law to the SRF. These fees are called contributions. The fund means that taxpayers are not first in line to pump money into a bank, should extra funding be required, since EU law requires all banks to pay into the fund annually.”

Press Release April 18, 2023:

ECB and SRB welcome the European Commission’s legislative proposals for the bank crisis management and deposit insurance framework

“Proposed legislative changes seen as important and pragmatic step forward

ECB and SRB ready to provide technical input on proposals to ensure consistent and workable framework

The European Central Bank (ECB) and the Single Resolution Board (SRB) welcome the European Commission’s proposed legislative changes to the European bank crisis management and deposit insurance framework.”

“Over the past ten years, Europe has already made significant progress in establishing a robust framework for dealing with banks in financial difficulties and bank failures. Taking this a step further is something we very much welcome,” said Luis de Guindos and Andrea Enria, respectively Vice-President and Chair of the Supervisory Board of the ECB. “The legislative proposals will enable theauthorities to manage bank crises in a more efficient and harmonised way and are therefore an important step towards completing the banking union.”

“The proposals contain many positive developments. For example, they clarify the scope of application of a resolution in relation to national liquidation procedures. They also enhance our toolkit for managing bank failures in a way that protects critical functions and citizens effectively,” said Dominique Laboureix, Chair of the SRB. “Going forward, it will be key to make sure – throughout the legislative process – that the different parts of the framework continue to form a coherent whole.”

The ECB and the SRB took part in the consultation process that led to the European Commission’s proposals and published related documents, such as the ECB contribution and the SRB contribution. Both institutions stand ready to provide technical input to further enhance the Commission’s proposals and ensure that the overall framework is consistent and workable.

However, experience has shown that many failing medium-sized and smaller banks have been managed with solutions outside the resolution framework. This sometimes involved using taxpayers' money instead of the bank's required internal resources or private, industry-funded safety nets (deposit guarantee schemes and resolution funds).

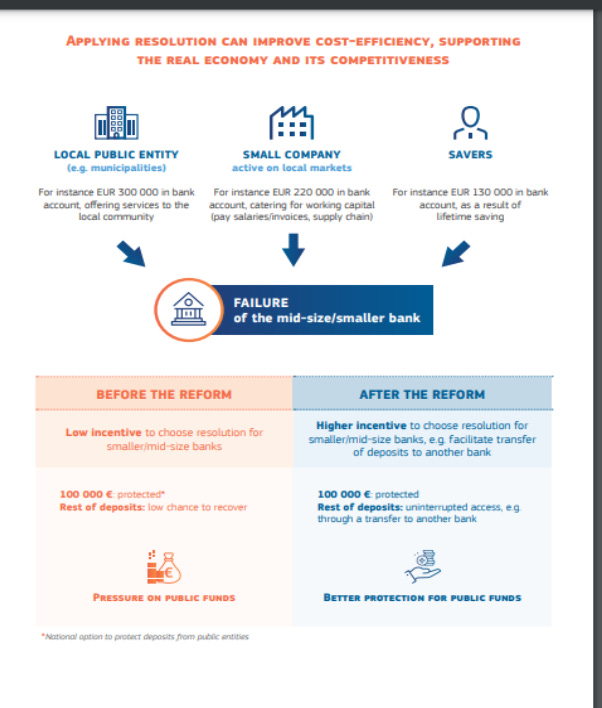

Today's proposal will enable authorities to organise the orderly market exit for a failing bank of any size and business model, with a broad range of tools. In particular, it will facilitate the use of industry-funded safety nets to shield depositors in banking crises, such as by transferring them from an ailing bank to a healthy one. Such use of safety nets must only be a complement to the banks' internal loss absorption capacity, which remains the first line of defence.

Overall, this will further preserve financial stability, protect taxpayers and depositors, and support the real economy and its competitiveness.

The proposal has the following objectives:

Preserving financial stability and protecting taxpayers' money

The proposal facilitates the use of deposit guarantee schemes in crisis situations to shield depositors (natural persons, businesses, public entities, etc.) from bearing losses, where this is necessary to avoid contagion to other banks and negative effects on the community and the economy. By relying on industry-funded safety nets (such as deposit guarantee schemes and resolution funds), the proposal also better protects taxpayers who do not have to step in to preserve financial stability. Deposit guarantee schemes can only be used for this purpose after banks have exhausted their internal loss absorption capacity, and only for banks that were already earmarked for resolution in the first place.

Shielding the real economy from the impact of bank failure

The proposed rules will allow authorities to fully exploit the many advantages of resolution as a key component of the crisis management toolbox. In contrast with liquidation, resolution can be less disruptive for clients as they keep access to their accounts, for example by being transferred to another bank. Moreover, the bank's critical functions are preserved. This benefits the economy and society, more broadly.

Better protection for depositors

The level of coverage of €100,000 per depositor and bank, as set out in the Deposit Guarantee Scheme Directive, remains for all eligible EU depositors. However, today's proposal harmonises further the standards of depositor protection across the EU. The new framework extends depositor protection to public entities (i.e. hospitals, schools, municipalities), as well as client money deposited in certain types of client funds (i.e. by investment companies, payment institutions, e-money institutions). The proposal includes additional measures to harmonise the protection of temporary high balances on bank accounts in excess of €100,000 linked to specific life events (such as inheritance or insurance indemnities).

Next steps

The legislative package will now be discussed by the European Parliament and Council.”

So you will note that BEFORE THE REFORM THAT THE SMALL BANK WILL STAY INTACT, but will have pressure on the tax payer. The reform needed to take place to ensure that the SMALL BANKS FAIL AND THAT THEIR DEPOSITS GET TRANSFERRED TO THE LARGER BANKS.

CBDC DOESN’T WORK IF SMALL BANKS AND REGIONAL BANKS, SUPPORTED BY TAX PAYERS CAN IN FACT SURVIVE. SO THIS LEGISLATION is like little nails in a coffin HAMMER HAMMER. what do you think.

I’m off base? This makes perfect sense? or perfect sense for a transformational change to a new financial order where you are part of a social credit system and very restricted. QUANTUM SPENDING, QUANTUM TAXATION, QUANTUM SPYING, QUANTUM SOCIAL CREDIT.

I’m open to your comments. Thank-you for being my readers.

The ECB is a bank. Its the bank with Sovereign over its fiat. One day methinks all banks bail into the ECB.

https://gregreese.substack.com/p/washington-to-castrate-minors-without

I am very alarmed no one is taking what WA state seriously. Child abduction and Rape was once such tabboos in our society.

I’m in Australia, and during the 2008 GFC our federal government bailed out the banks. Shortly after they stated, and passed legislation that next time it would be a “bail in” meaning any deposits you had deposited n the bank or securities held by them becomes the banks. Remember you will own nothing and you will be happy. That bill from Washington is an exact replica of the latest UN agenda - decriminalisation of all sex offences,homelessness, and drug offences. In Victoria we already have laws that can see a professional, parent charged and or jailed for trying to “counsel “ a child with a belief they are the opposite gender. Street prostitution has been legalised and prostitutes are no longer obliged to have checks for sexually transmitted disease. We also have a legalised injecting room where Narcan , needles etc are supplied, with more on the way. This injection room is next to a primary school ( grades up to 6th class) . The kids have to walk past people fornicating, shooting up, and on at least one occasion a dead person. CRT , gender ideology and climate change are mandatory in all our schools. Curitiba here are already living the nightmare.